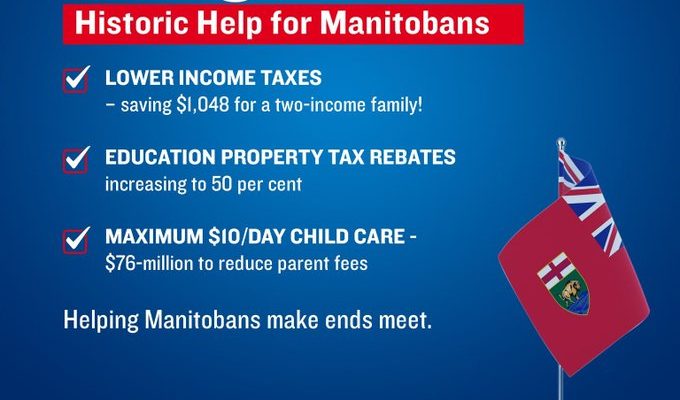

Manitoba Historic Tax Relief. Image credit Twitter @CliffCullenMLA

Winnipeg/CMEDIA: Historic investments are being made by the Manitoba government to bring total tax and affordability measures to more than $1.8 billion between 2022 and 2024, providing $5,500 in total savings for the average two-income family by 2024, Finance Minister Cliff Cullen stated today in a news release.

“We have a Low Tax Plan to make Manitoba a more affordable place to live, and a more competitive place to do business…will help the economy prosper because we understand that affordability and tax competitiveness is the key to creating good local jobs for Manitobans,” said Cullen.

Increases in the School Tax Rebate for residential and farm properties this year from 37.5 percent in 2022 to 50 percent in 2023 would cause increase in the average rebate to a homeowner to $774 in 2023 from $581 in 2022.

Rebates are delivered the month in which municipal property taxes are due and will begin being received in Winnipeg and Brandon in June.

A 10 percent rebate of the total of both the school division special levy and the education support levy payable would be received by the owners of other properties including commercial, industrial, institutional properties.

“Arbitrarily determining who receives a rebate on the taxes they pay based on who owns a company or the size of their contributions to Manitoba’s economy not only undermines the importance of fairness and trust, it’s simply bad tax policy. Tax rebates allow retailers to lower prices, create jobs and invest in their businesses,” said John Graham, prairie director, Retail Council of Canada.

#Manitoba; #HistoricTaxRelief